Retirement & Estate Planning

Get a customized plan so you can better enjoy retirement

Your Path to Peace in Retirement

1) Schedule a Conversation

Whether you’d like to meet at one of our offices, over the phone, or through a video call, your first step is to schedule a casual conversation where we get to know more about you.

2) We Create a Customized Plan

Your needs and goals are unique, and we believe your financial plan should be as well. Your Welshire Wealth Advisor will create a customized plan that helps you meet your goals.

3) You'll Have Peace in Retirement

You’ve worked hard to get to where you are. Confusion about finances can make your retirement stressful. We believe your finances should be a source of peace, not confusion.

Are you confident about your retirement?

At Welshire, we know you want to have peace in retirement. In order to do that, you need a customized plan for your income and assets. The problem is, you don’t know who to trust and you’re left feeling confused.

We believe your finances should be a source of peace, not confusion.

It’s going to be okay! We know finding a financial advisor is complicated, but since 1984, we’ve helped hundreds of people retire more peacefully, and we’d love to help you, too.

Here’s how it works: 1) Schedule a conversation, 2) We’ll create a customized plan, and 3) Have peace in retirement. It’s really that simple. We promise to listen to your needs, work hard for you and your money, and be available to you and your family.

Schedule a conversation with us, so you can avoid feeling stressed and confused about your money, and instead, enjoy your retirement, have a plan and team you can trust, and feel prepared and confident.

We’ve Got You Covered

700+

families retiring with more confidence and peace of mind

100+

companies helped with 401(k) plans, business transition or succession

$7B

of assets under management for Valmark Advisers

Imagine the retirement you’ve always wanted. At Welshire, we want to help make that dream a reality.

Services For Your Unique Needs

Financial Planning

Key Person Insurance Review

Insurance Review

Philanthropy Consulting

Retirement Planning

401k Plans

Retirement Income Analysis

Social Security Study

Executive Compensation

Business Valuation

Estate Planning

Investment Tax Planning

We Look Forward to Getting to Know You Better

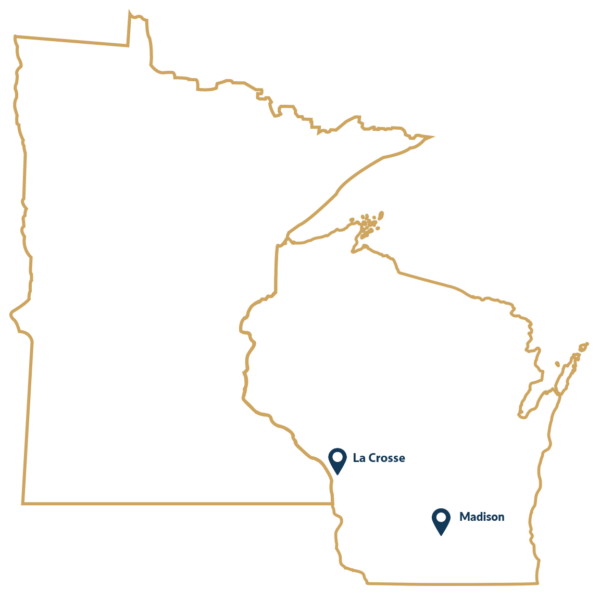

Madison

La Crosse Area